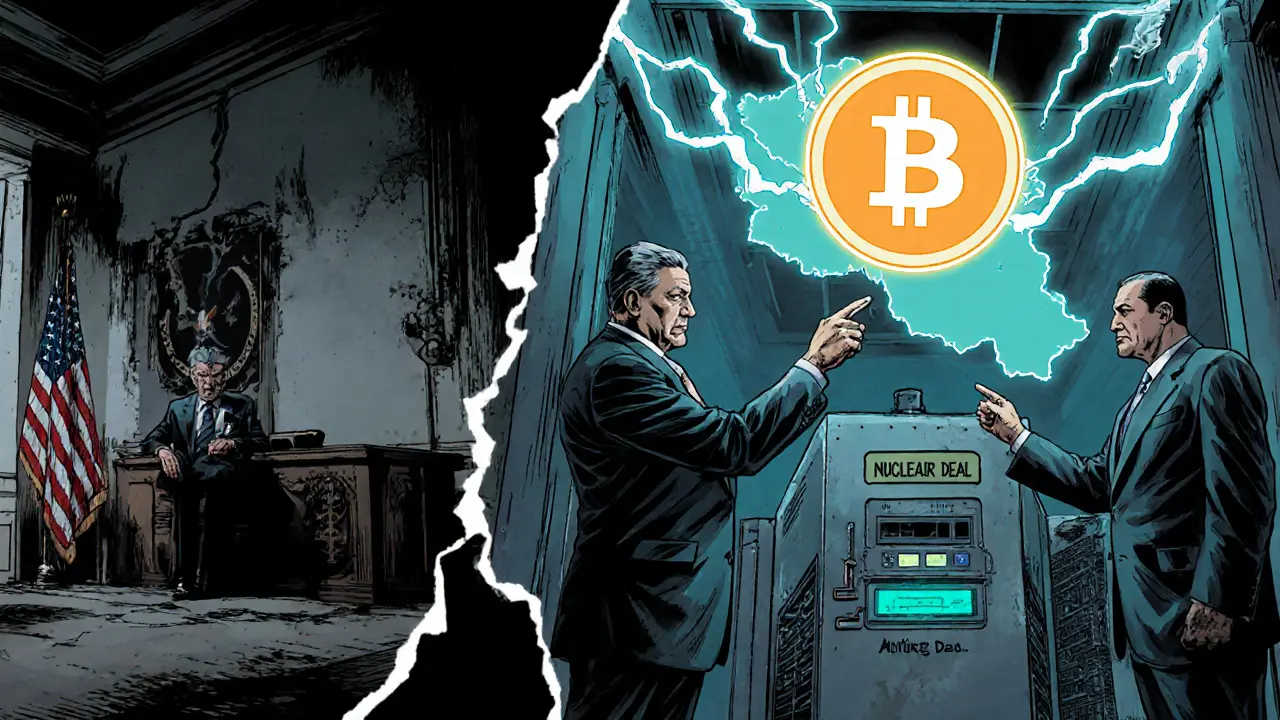

How Iran Uses Bitcoin Mining to Bypass Sanctions

Iran turns cheap electricity into Bitcoin profits to dodge sanctions, using state subsidies, IRGC support, and global crypto networks for foreign‑currency revenue.

When discussing Sanctions Evasion, the practice of bypassing government‑imposed economic restrictions to move or use digital assets. Also known as sanction circumvention, it usually involves hidden wallets, mixers, or offshore exchanges that help users skirt official bans. Sanctions evasion is more than a legal gray zone; it creates real market distortion, fuels illicit financing, and puts every participant at risk of sudden asset freezes. Imagine an exchange that advertises low fees but silently routes Russian rubles into U.S. dollars through a chain of anonymous contracts—that’s a classic evasion pattern. Understanding how these schemes work lets you spot red flags early and avoid costly setbacks.

One of the first concepts to grasp is crypto compliance, the set of policies and procedures exchanges, token projects and service providers follow to meet legal standards. Good compliance programs require robust KYC checks, transaction monitoring, and clear reporting channels. Next, look at FATF regulations, global anti‑money‑laundering standards that dictate how virtual asset service providers must identify and block sanctioned parties. The FATF’s “travel rule” forces platforms to share sender and receiver details across borders, directly targeting evasion routes. Then there’s AML, anti‑money‑laundering measures that monitor, detect and report suspicious activity in the financial system, often paired with KYC to prove user identity. Sanctions evasion encompasses illicit cross‑border transfers, while crypto compliance requires transparent user onboarding—this relationship creates a feedback loop: stronger compliance reduces evasion opportunities, and lower evasion risk encourages regulators to relax overly harsh measures. FATF regulations influence AML practices by setting a baseline; in turn, effective AML programs help platforms pass FATF audits and stay on reputable whitelist lists. The triple connection—sanctions evasion ↔ crypto compliance ↔ FATF regulations—forms the backbone of a safe crypto ecosystem.

Below you’ll find a curated set of articles that dive deep into real‑world examples, from exchange reviews that expose hidden risks to detailed breakdowns of how different jurisdictions enforce sanctions. Whether you’re a trader looking for a compliant platform, a developer building DeFi tools, or just curious about the latest regulatory trends, the collection gives you actionable insights and a clear roadmap to stay out of trouble while navigating the fast‑moving crypto landscape.

Iran turns cheap electricity into Bitcoin profits to dodge sanctions, using state subsidies, IRGC support, and global crypto networks for foreign‑currency revenue.

An in‑depth look at North Korea's 2025 crypto ban, the record‑breaking ByBit hack, money‑laundering via Cambodia's Huione Group, and the U.S. response with sanctions and rewards.