Staking your crypto used to mean locking it up for months-no trading, no using it in DeFi, just waiting for rewards. Then came liquid staking, and everything changed. Now you can stake ETH, SOL, or ATOM and still use your tokens like cash. But here’s the catch: not all liquid staking platforms pay the same. Some offer 3% APY. Others push 18%. And the difference isn’t just in the numbers-it’s in risk, control, and how your money actually works after you stake it.

Why Liquid Staking Matters More Than Ever

Liquid staking isn’t just a fancy upgrade. It’s the bridge between earning rewards and staying active in DeFi. Before it existed, if you staked Ethereum, your ETH was frozen. You couldn’t lend it, trade it, or use it as collateral. Now, you get a token-like stETH or rETH-that represents your staked ETH and can be used anywhere. That means you earn staking rewards and can earn more by lending your stETH on Aave or trading it on Uniswap. It’s double dipping, without the double risk.

As of early 2026, over $28 billion is locked in liquid staking protocols. Ethereum still leads, but Solana and Cosmos are catching fast. Why? Because yields are higher. And for many, that’s the main draw.

Ethereum Liquid Staking: The Big Three

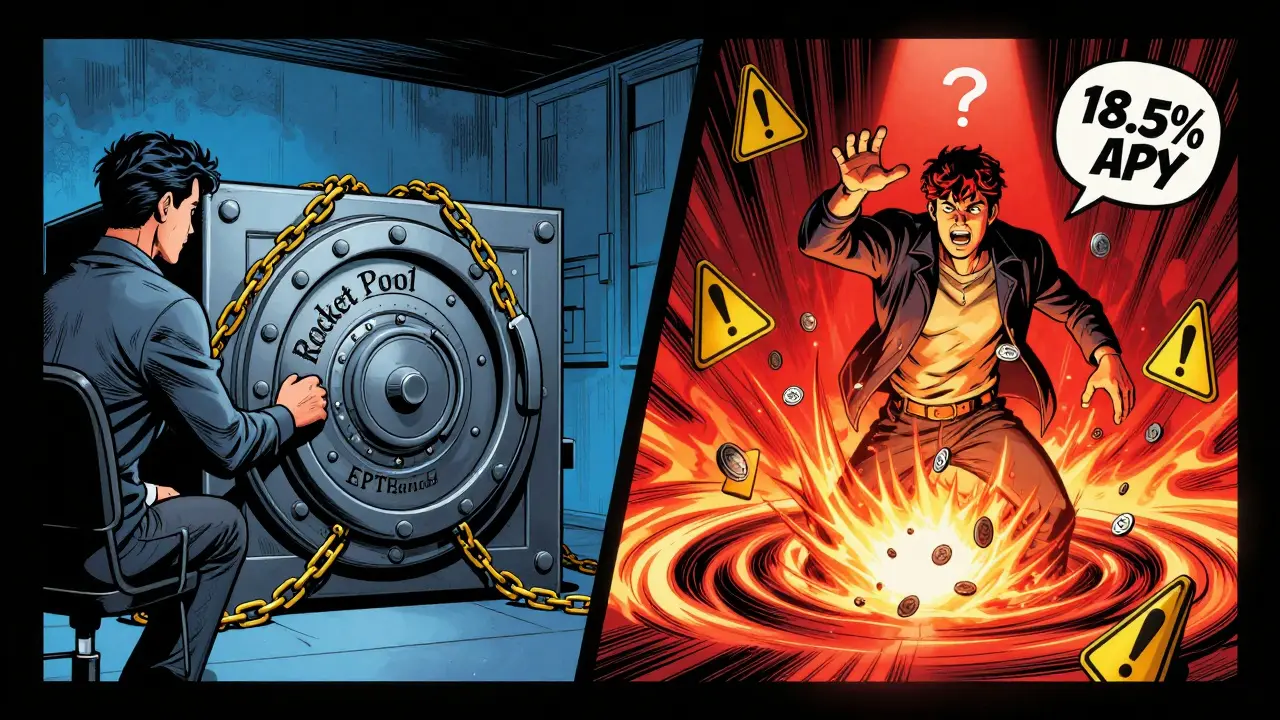

If you’re staking ETH, you’ve got three main choices: Lido, Rocket Pool, and Binance. Each has a different trade-off between ease of use, decentralization, and yield.

- Lido Finance (stETH) - 3.00% APY. This is the default for most people. It’s simple: connect your wallet, stake ETH, get stETH. No minimum. Works with almost every DeFi app. But Lido controls nearly 30% of all staked ETH. That’s a centralization risk. If something goes wrong with Lido’s infrastructure, it could ripple through the whole ecosystem.

- Rocket Pool (rETH) - 2.54% APY. This one’s built to be more decentralized. Instead of a single company running validators, Rocket Pool lets anyone run a node with just 16 ETH (plus a small amount of RPL collateral). The yield is lower, but you’re helping make Ethereum more secure. rETH trades at a slight premium to ETH because of its decentralized reputation. But liquidity can be spotty on smaller DEXs.

- Binance (WBETH) - 2.71% APY. If you already use Binance, this is the easiest route. No wallet setup. Just click and stake. Binance handles everything. But you’re trusting a centralized exchange with your assets. If Binance gets hacked, regulated, or shut down in your country, your stETH is stuck. No recovery. No decentralization. Just convenience.

Here’s how they stack up:

| Platform | Token | APY | Min Stake | Decentralization | DeFi Compatibility |

|---|---|---|---|---|---|

| Lido Finance | stETH | 3.00% | 0.0001 ETH | Medium | Excellent |

| Rocket Pool | rETH | 2.54% | 16 ETH | High | Good |

| Binance | WBETH | 2.71% | 0.1 ETH | Low | Good |

Most beginners pick Lido. It’s the most flexible. But if you care about Ethereum’s long-term health, Rocket Pool is the quiet hero. Binance? Only if you’re okay with trusting a corporation with your crypto.

Solana and Cosmos: Higher Yields, Higher Risk

Ethereum’s yields are steady but modest. If you want more, look beyond ETH.

Solana offers 6-8% APY through mSOL (Marinade Finance) or jSOL (Jito). Solana’s network is faster and cheaper, but it’s also more volatile. In 2023, it had a major network outage. In 2025, it’s stable-but still not as battle-tested as Ethereum. mSOL is widely accepted in DeFi, and you can even stake it again on some platforms for extra yield. But if Solana goes down again, your rewards pause. Your tokens don’t vanish, but they stop growing.

Cosmos (ATOM) is the yield king. You can earn up to 18.5% APY by staking through Cosmostation, Keplr, or Lido’s ATOM liquid staking. That’s not a typo. But here’s the catch: Cosmos is a network of independent blockchains. If one validator gets slashed (punished for misbehavior), your liquid staking token (aATOM) could lose value. And unlike ETH, ATOM isn’t widely used in DeFi. You can’t easily lend it. You can’t easily swap it. You’re mostly stuck holding it and waiting for rewards.

High APY doesn’t mean high value. It means high risk. Most people treat Cosmos staking like a speculative bet-not a savings account.

Multi-Chain Platforms: One Platform, 30+ Chains

What if you want to stake ETH, SOL, ATOM, and even lesser-known chains like Polygon or Kava-all in one place? That’s where Stakely and Coinbase Staking come in.

Stakely supports over 30 blockchains. Some offer 15% APY. Others go as high as 53%. But here’s the reality: those 53% yields are usually on new, low-liquidity chains. They’re risky. Many are experimental. Some have no real user base. The reward is high because the risk is too.

For most, Stakely works best as a tool for diversifying small positions-not as a primary staking hub. Use it for testing new chains, not for your life savings.

Coinbase Staking is simpler. It doesn’t offer liquid staking tokens. You just earn rewards directly. But you can’t use your staked assets in DeFi. So it’s not true liquid staking. It’s just staking with a user-friendly interface.

What You’re Really Paying For

APY isn’t the whole story. Platforms take a cut. Usually between 2% and 10% of your gross staking rewards.

Let’s say Ethereum’s base staking reward is 5%. Lido takes 10%, so you get 4.5%. Rocket Pool takes 15%, so you get 4.25%. But wait-Rocket Pool’s yield is lower because it’s more decentralized. You’re paying for security, not just yield.

Also, some platforms charge gas fees when you claim rewards or swap tokens. Others don’t. Lido has low fees. Binance has no gas fees if you stay on their platform. But if you move your stETH to a DEX, you pay Ethereum gas. That adds up.

Hidden Risks Nobody Talks About

Most guides focus on APY. Few mention the real dangers:

- Depegging: stETH sometimes trades below 1 ETH during market panic. In 2023, it dropped to 0.96 ETH. You didn’t lose ETH-you lost liquidity. If you need to sell fast, you take a hit.

- Slashing: If a validator goes offline or acts maliciously, you lose part of your stake. This is rare on Ethereum, but common on smaller chains.

- Regulation: The SEC hasn’t ruled on LSTs yet. If they classify stETH as a security, exchanges might delist it. Your DeFi access could vanish overnight.

- Taxes: In the U.S., Canada, Australia, and the EU, swapping ETH for stETH is a taxable event. You might owe capital gains tax just for staking. Many users don’t realize this until tax season.

Who Should Use What?

Here’s a simple guide:

- Beginner, want simplicity → Lido (stETH)

- Believe in decentralization → Rocket Pool (rETH)

- Already on Binance → WBETH

- Want higher yield, okay with risk → mSOL (Solana)

- Chasing max yield, don’t need DeFi → ATOM via Cosmostation

- Testing new chains → Stakely (small amounts only)

Don’t put all your ETH into one platform. Split it. 60% in Lido, 30% in Rocket Pool, 10% in mSOL. That way, if one fails, you’re not wiped out.

What’s Next in Liquid Staking?

By mid-2026, expect more innovation:

- Restaking: EigenLayer lets you re-stake your stETH to secure other protocols. You earn extra yield-sometimes 1-3% more.

- Regulatory clarity: Platforms are building tax reporting tools. Lido and Coinbase now offer CSV exports for tax software.

- Cross-chain LSTs: You’ll soon be able to use stETH on Solana or ATOM on Ethereum. That’s the next big leap.

Liquid staking is here to stay. But it’s not a set-it-and-forget-it tool. It’s a dynamic system. You need to watch it, adjust it, and understand the trade-offs.

Is liquid staking safe?

It’s safer than leaving crypto on an exchange, but not risk-free. Smart contract bugs, slashing, and platform failures can cause losses. Stick to well-audited platforms like Lido and Rocket Pool. Avoid high-yield staking on unknown chains unless you’re willing to lose the money.

Do I pay taxes when I stake ETH for stETH?

Yes. In most countries, exchanging ETH for stETH is treated as a sale. You owe capital gains tax on the difference between your original ETH purchase price and its value when you swapped it. Many users get hit with unexpected tax bills because they didn’t track this. Use tools like Koinly or TokenTax to automate it.

Can I lose my staked ETH?

You won’t lose your ETH unless the entire Ethereum network fails. But you can lose value if your LST depegs (e.g., stETH drops to 0.95 ETH) or if the platform gets hacked. Rocket Pool reduces this risk through decentralization. Lido and Binance carry more counterparty risk.

What’s the best liquid staking platform for beginners?

Lido Finance. It’s the easiest to use, works with the most DeFi apps, and has the lowest entry barrier. You can stake as little as 0.0001 ETH. Just connect your wallet and go. Avoid Binance if you want true decentralization. Avoid Rocket Pool if you don’t want to learn how to use a wallet.

Should I stake ETH or SOL for higher APY?

If you want safety and DeFi access, stake ETH. If you want higher returns and don’t mind volatility, try SOL. ETH’s APY is stable. SOL’s can swing from 6% to 12% in months. Also, ETH has far more liquidity. You can sell stETH anytime. mSOL might take longer to trade at a fair price during a crash.

Don’t chase the highest APY. Chase the right balance of yield, security, and usability. Liquid staking gives you power-but only if you use it wisely.

Joshua Clark

January 28, 2026 AT 22:05Okay, so I’ve been staking through Lido for like 18 months now, and honestly? It’s been smooth as butter. I mean, I’ve got stETH in Aave, Compound, and even used it as collateral on Maple Finance-and never had a hiccup. But I get why people are nervous about centralization. Lido’s got 30% of all staked ETH? That’s wild. I’ve considered dipping into Rocket Pool, but 16 ETH minimum? I’d need to sell my car. Still, I respect the ethos. I think the real win here is that even if Lido goes sideways, the market’s so deep that stETH trades within 1% of ETH almost always. And if you’re using it in DeFi? You’re already diversified. Just don’t go all-in on one platform. Split it. 60/30/10 like the post says. That’s the move.

Katie Teresi

January 29, 2026 AT 11:30Lido is a centralized scam wrapped in DeFi glitter. If you’re not using Rocket Pool, you’re just giving your money to a corporation pretending to be decentralized. Wake up.

Moray Wallace

January 31, 2026 AT 05:33Interesting breakdown, especially on the tax implications. I didn’t realize swapping ETH for stETH triggered a taxable event in the EU. That’s going to require some serious bookkeeping. I’ve been using Lido for simplicity, but now I’m reconsidering whether the convenience is worth the potential tax headache. Maybe I’ll move a small portion to Rocket Pool just to hedge. Thanks for the clarity.

Lori Quarles

February 2, 2026 AT 00:20Y’all are overthinking this. If you’re not chasing 18% APY on ATOM, you’re leaving money on the table. I’ve been staking through Cosmostation since last year-yes, it’s risky, but so is keeping cash in a bank. The world’s moving fast. If you’re not taking risk, you’re losing. 🚀🔥

Jeremy Dayde

February 2, 2026 AT 13:30I’ve been in crypto since 2017 and I’ve seen so many hype cycles come and go. Liquid staking feels different because it actually solves a real problem-locking up your assets. But I think people forget that yield isn’t the only metric. It’s about resilience. I’ve got half my ETH in Rocket Pool because I believe in the network’s security more than I believe in a 0.5% higher APY. Also, the fact that rETH trades at a premium tells you something. People are voting with their wallets. And yeah, the gas fees are annoying but it’s worth it. I’ve had stETH depeg before and it was scary. I don’t want to go through that again. So I’m staying on the side of caution.

Steven Dilla

February 3, 2026 AT 10:17ATOM at 18.5%? Bro that’s not staking that’s gambling 😭 I lost 40% on a Solana LST last year because the chain went down for 12 hours. Don’t be that guy. Stick to ETH. Rocket Pool for the win. 💪