Iran Crypto Compliance Checker

Check Your Crypto Compliance

Compliance Results

Iran doesn’t ban cryptocurrencies. But if you think that means free trade, you’re wrong. The government doesn’t stop you from owning Bitcoin or mining Ethereum - it just makes sure it controls every step of the way. By December 2025, Iran’s crypto scene is a tightly monitored system where legality depends on permission, paperwork, and power bills.

Legal, but Only If the Government Says So

Cryptocurrencies are legal in Iran - but only under strict conditions set by the Central Bank of Iran (CBI). In early 2025, Governor Mohammadreza Farzin officially approved the country’s first comprehensive regulatory framework for digital assets. This wasn’t a liberalization. It was a takeover. The CBI now has direct, real-time access to every transaction, wallet, and mining rig registered under the law. If you’re trading, mining, or exchanging crypto, you’re not just using a platform - you’re operating under state surveillance.

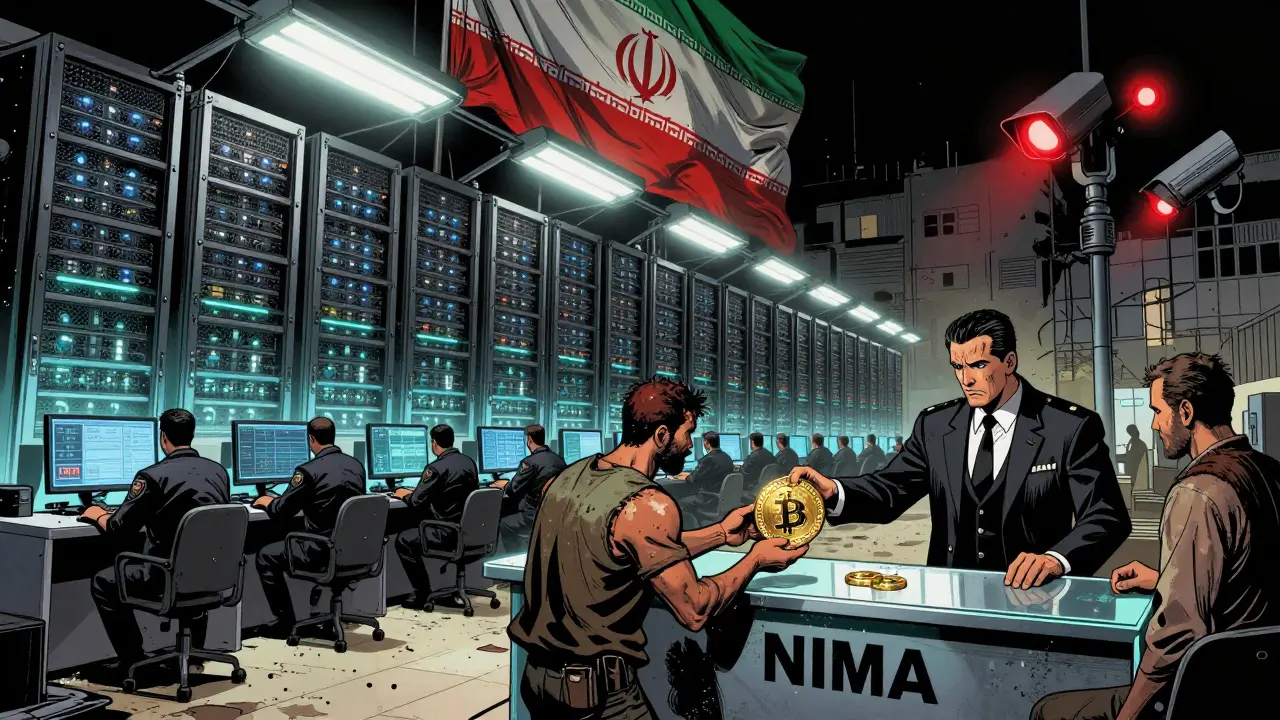

Before 2019, crypto mining was a wild west of underground farms draining the national grid. The government didn’t shut it down. Instead, it decided to own it. That’s when mining became legal - but only if you got a license from the Ministry of Industry, Mine and Trade. Today, over 1,000 licensed mining operations are registered. But experts estimate 95% of mining still happens illegally. Why? Because the rules are expensive and the penalties are harsh.

Miners Must Pay More, Sell to the State, and Use Approved Hardware

Legal miners don’t get cheap electricity. In fact, they pay more than export rates. The Ministry of Energy pegs mining power prices to international benchmarks, not the heavily subsidized rates regular Iranians get. That’s intentional. The goal isn’t to help miners - it’s to stop them from overloading the grid. Even licensed operations face strict consumption limits enforced by the Ministry of Energy.

And here’s the catch: every coin you mine must be sold to the Central Bank of Iran through the National Iranian Money Changer Association (NIMA). You don’t get to keep your Bitcoin. You don’t get to trade it on Nobitex or Binance. You sell it to the state, and they turn it into rials for their coffers. This isn’t a suggestion - it’s mandatory. The government uses this system to control foreign currency inflows and reduce reliance on the U.S. dollar.

Hardware matters too. Only government-approved mining rigs are allowed. If you show up with a batch of Antminer S19s bought from a smuggler, you’re not just breaking the rules - you’re risking seizure. In August 2025, authorities dismantled over 100 illegal mining farms and confiscated more than 250,000 unlicensed devices. That’s not a warning. It’s a message.

Trading Crypto? You Need a License - and a Paper Trail

Buying or selling crypto isn’t a peer-to-peer game anymore. Whether you’re an individual or a business, you need a license from the CBI to trade. The January 2025 directive made this clear: all digital asset transactions must go through CBI-approved channels. That means no anonymous wallets. No offshore exchanges. No untraceable transfers.

Brokers must use designated bank accounts to convert crypto to rials. Every transaction is logged. Platforms that want to offer payment gateways must pass AML and KYC checks that rival those in the EU. Even crypto influencers promoting trading platforms now operate under regulatory scrutiny. The government doesn’t want to stop crypto - it wants to make sure it profits from it.

One platform still dominates: Nobitex. In 2022, it handled 87% of Iran’s crypto volume. In 2025, it still does. But even Nobitex isn’t free from control. It’s one of the few exchanges with a CBI license. That’s why it survives. Others? They’re either shut down or forced underground.

Capital Gains Tax Is Now a Reality

In August 2025, Iran introduced its first-ever capital gains tax on cryptocurrency. Trading Bitcoin for profit? You owe taxes. Same as if you bought gold, real estate, or traded forex. The Law on Taxation of Speculation and Profiteering brought crypto into the same legal bucket as other speculative assets. This wasn’t just about revenue - it was about legitimacy. The government is now treating crypto like a financial instrument, not a rebellion tool.

The tax kicked in with a phased rollout in Q3 2025. Traders are expected to report gains quarterly. The CBI is working with the National Tax Administration to cross-check wallet addresses with bank records. If you made $10,000 in crypto profits this year and didn’t report it, you’re not just risking fines - you’re risking criminal charges.

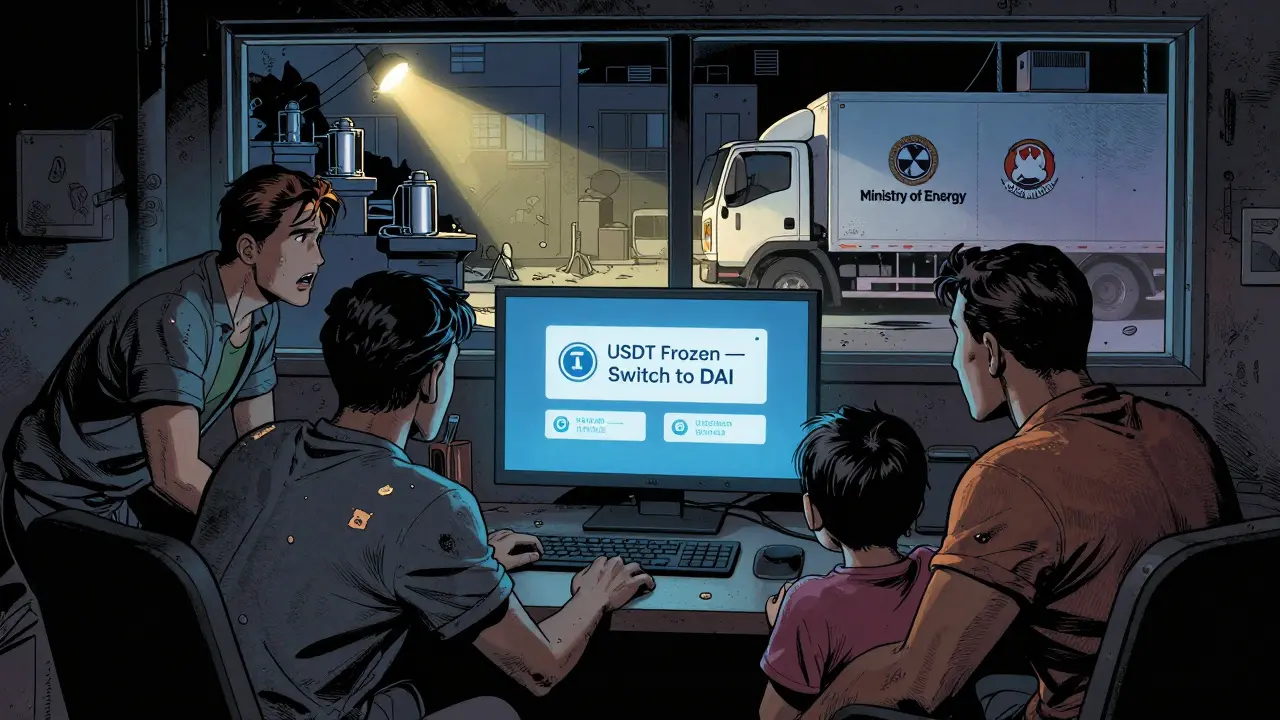

Sanctions, Stablecoins, and the Great USDT Exodus

Iran uses crypto to bypass sanctions. That’s no secret. But it’s not all about smuggling weapons or buying drones. For ordinary Iranians, crypto is a lifeline. With inflation hitting 40% and the rial collapsing, Bitcoin and stablecoins became a way to save money, pay for medicine, or send cash to family abroad.

Then came July 2025. Tether froze hundreds of Iranian-linked USDT addresses. Overnight, a major part of Iran’s digital economy froze. The response was fast and clever. Exchanges, influencers, and even state-aligned media pushed users to swap USDT for DAI - a decentralized stablecoin built on the Polygon network. Within weeks, DAI became the new default. It wasn’t about ideology. It was about survival. Iran’s crypto community adapted faster than most governments could react.

TRM Labs reported that illicit transactions on Iranian exchanges account for just 0.9% of total activity. That means 99.1% of crypto use is for everyday economic survival - not crime. The government knows this. That’s why it hasn’t cracked down on users. It’s cracking down on the unlicensed infrastructure that enables them.

The Bigger Picture: Crypto as a Tool of Economic Resistance

Iran isn’t trying to become a crypto hub like Singapore or Switzerland. It’s using crypto to survive. The country has explored gold-backed stablecoins with Russia for cross-border trade. It allows companies to pay for imports in crypto - a move first announced in 2023. The goal? Reduce dependence on the SWIFT system and the U.S. dollar.

Total crypto flows in Iran dropped 11% between January and July 2025 - down to $3.7 billion. That’s partly due to tighter controls. But it’s also because global pressure is mounting. Western sanctions make it harder to move crypto out of Iran. Exchanges face delisting. Banks cut ties. Even trusted platforms like Binance have quietly restricted Iranian access.

Yet, crypto use hasn’t collapsed. It’s evolved. People use peer-to-peer networks. They trade through Telegram bots. They mine in basements and garages, risking fines to keep their savings alive. The government doesn’t want to eliminate crypto - it wants to control it. And so far, it’s winning.

What This Means for You

If you’re an Iranian citizen: you can trade, mine, and hold crypto - but only if you play by the state’s rules. Get a license. Pay the power bill. Sell to NIMA. Report your gains. Skip any of these, and you’re not just breaking the law - you’re risking your equipment, your money, and your freedom.

If you’re outside Iran and thinking of sending crypto to someone there: be careful. Sending USDT to an Iranian address could trigger a freeze. DAI is safer, but not risk-free. The government monitors incoming flows. The CBI knows who’s receiving what. There’s no anonymity here.

If you’re a business looking to operate in Iran’s crypto space: forget about independence. You need state approval for everything. Your profits will be taxed. Your data will be shared. Your hardware will be inspected. This isn’t a market - it’s a regulated zone.

Iran’s crypto story isn’t about freedom. It’s about control. The government didn’t outlaw digital money. It absorbed it. And now, it’s using it to keep the economy from collapsing - while keeping its citizens under watch.

Is cryptocurrency legal in Iran?

Yes, but only under strict government control. Mining and trading are legal if you have a license from the Central Bank of Iran (CBI) and follow all rules, including selling mined coins to the state and paying higher electricity rates. Unlicensed activity is illegal and subject to seizure and fines.

Can I mine Bitcoin in Iran legally?

You can, but only if you get a license from the Ministry of Industry, Mine and Trade, use government-approved hardware, pay export-priced electricity, and sell all mined cryptocurrency to the Central Bank of Iran through NIMA. Most miners operate illegally because the costs and restrictions make it nearly impossible to profit legally.

Do I have to pay taxes on crypto profits in Iran?

Yes. Since August 2025, Iran has imposed a capital gains tax on cryptocurrency trading, treating it the same as gold, real estate, and forex. Traders must report profits quarterly to the National Tax Administration, and the CBI cross-checks wallet data with bank records.

Why did Iranian users switch from USDT to DAI?

In July 2025, Tether froze hundreds of Iranian-linked USDT addresses due to sanctions pressure. To maintain access to liquid digital cash, Iranian exchanges and users rapidly migrated to DAI, a decentralized stablecoin on the Polygon network. This shift was coordinated by local platforms and influencers to avoid financial isolation.

Can foreigners send crypto to Iran?

Technically yes, but it’s risky. Sending USDT to Iranian addresses often triggers freezes. DAI is less likely to be blocked, but all incoming transactions are monitored by the Central Bank of Iran. There’s no guarantee funds will reach their destination, and recipients could face scrutiny or legal action if they don’t comply with reporting rules.

What happens if I mine crypto without a license in Iran?

Your mining equipment will be seized. You could face fines, criminal charges, or both. In 2025, authorities dismantled over 100 illegal mining farms and confiscated more than 250,000 unlicensed devices. The Ministry of Energy actively encourages citizens to report illegal operations.

Is Nobitex still the main crypto exchange in Iran?

Yes. Nobitex still handles the majority of Iran’s crypto volume, despite a 11% decline in overall market activity in 2025. It’s one of the few exchanges with official CBI approval, giving it a monopoly-like position. Other platforms either shut down or operate illegally.

Sarah Roberge

December 1, 2025 AT 21:02Jess Bothun-Berg

December 2, 2025 AT 22:45Steve Savage

December 4, 2025 AT 06:31samuel goodge

December 6, 2025 AT 01:36alex bolduin

December 6, 2025 AT 13:39Vidyut Arcot

December 6, 2025 AT 20:42Jay Weldy

December 8, 2025 AT 12:31Melinda Kiss

December 8, 2025 AT 15:06Christy Whitaker

December 9, 2025 AT 22:52Nancy Sunshine

December 10, 2025 AT 12:48Alan Brandon Rivera León

December 12, 2025 AT 11:40Mohamed Haybe

December 13, 2025 AT 07:24Marsha Enright

December 13, 2025 AT 10:56Andrew Brady

December 14, 2025 AT 06:38Sharmishtha Sohoni

December 14, 2025 AT 10:06Althea Gwen

December 15, 2025 AT 15:34Durgesh Mehta

December 16, 2025 AT 18:15ashi chopra

December 18, 2025 AT 16:24Darlene Johnson

December 20, 2025 AT 00:34Ivanna Faith

December 21, 2025 AT 04:18Akash Kumar Yadav

December 21, 2025 AT 12:06Tatiana Rodriguez

December 22, 2025 AT 08:48Steve Savage

December 24, 2025 AT 08:37